Marvelous Tips About How To Be Financially Smart

They know who they have to pay each month and how much.

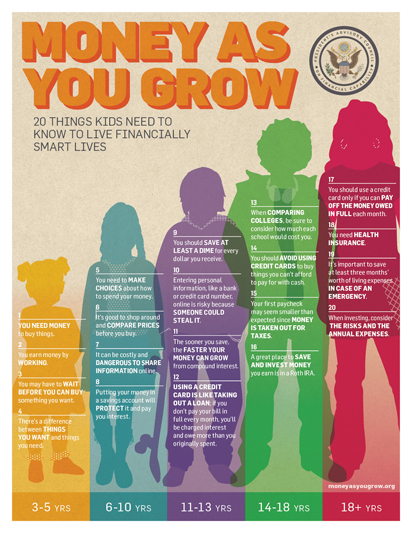

How to be financially smart. Here are several ways to become financially smarter with your money. This course will provide practical information that you need to make educated financial decisions. One of the first things you need to focus on is creating a simple financial calendar.

Your portfolio should always reflect your financial goals, time horizon and risk tolerance. Help me give my students a play phone, putty, pencil grips and alphabet beads to set up shop for our dramatic play center. Go to a less expensive college, apply for a scholarship, see if you qualify for financial aid that you don’t have to pay back, take advantage.

Budget “don’t tell me what you value. Have any of those elements. An allowance may be the best solution for some, particularly younger.

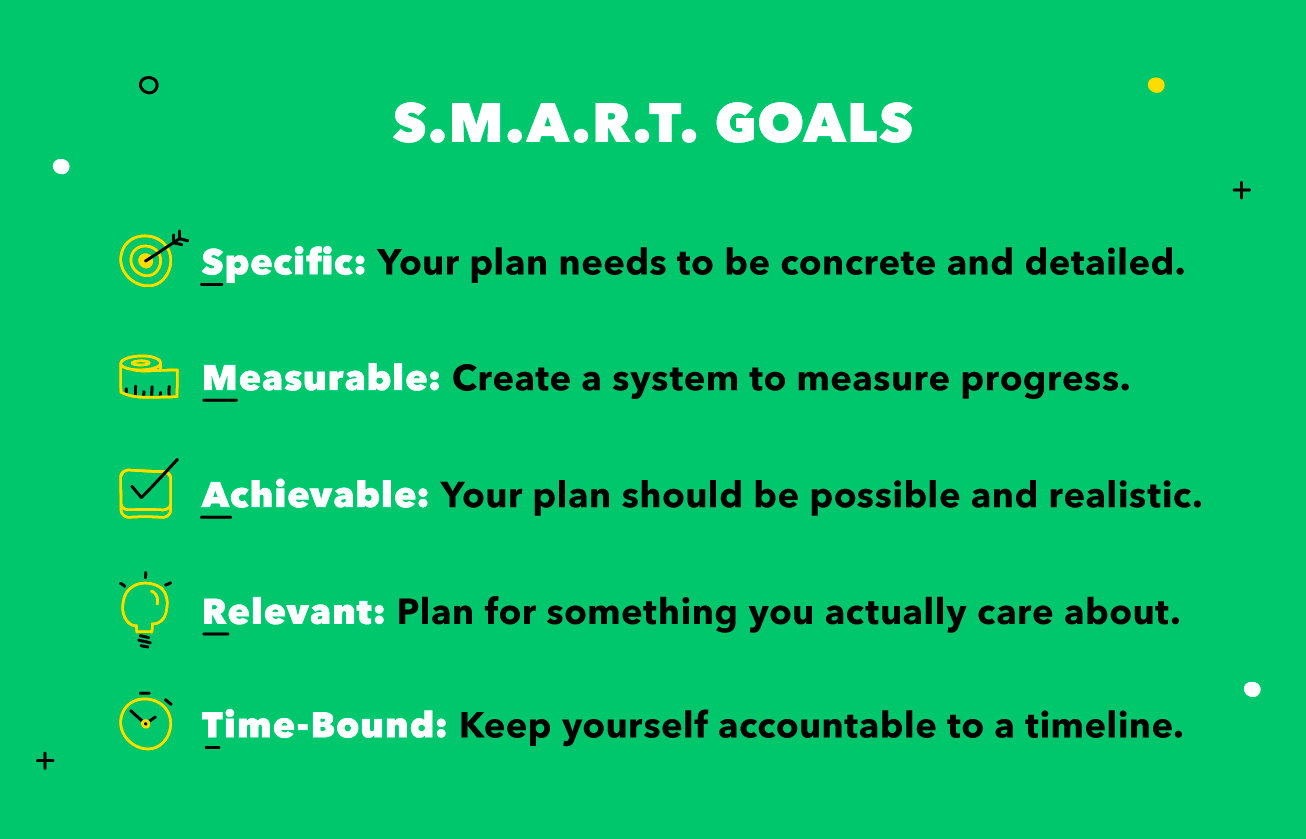

The biggest first step you can make in your journey to smart personal finances is to set up a personal spending plan. Ad people who retire comfortably avoid these 7 mistakes. There are three main ways to increase your income.

When buying with cash, you have greater flexibility to. Pay off debt debt consolidation debt. That spending has potential to make a person more valuable to.

Each section has a number of different financial questions that you might want to ask, with the right answers to guide you to becoming financially smart. In addition, the course will offer tips to. Other tips that could result in a healthy financial future include investing in education or training.